If the world is successful in reducing emissions sufficiently to avoid dangerous climate change, there is a limited future for a prospering oil-sands sector in Canada. The conventional wisdom among the Canadian establishment is that growing the oil-sands business is compatible with meeting national and global emissions commitments. This is a myth that obscures government policy contradictions.

In a recent Globe and Mail article Environmentalists should end the charade over the oil sands, Martha Hall Findlay and Trevor McLeod argue that keeping oilsands in the ground and stopping new oil pipelines will actually increase global greenhouse gas emissions.

Their argument rests on two premises:

- Oil demand won’t start to fall until 2040. After that it will remain high for many years.

- Oil-sands production is becoming less emissions intensive thanks to improving technology. If oil-sands consumption by US refineries were replaced by, say, more emissions-intensive Venezuelan heavy crude, then global emissions would increase.

I won’t dispute the second point in detail, at least for now. The case I’m making here does not depend on rebutting it. If overall oil-sands upstream emissions intensities really are falling due to improved technology, that’s welcome news. But I haven’t seen the most recent average emissions data that back it up. My understanding is that newer projects are predominantly in-situ facilities that are more emissions intensive than mines, so that the average GHG emissions per barrel is actually rising slowly.

My focus here will be the first point, where Hall Findlay and McLeod made an important error by misrepresenting the scenarios from the IEA’s World Energy Outlook 2016. They wrote:

The story starts with global energy forecasts. Even if there is very aggressive adoption of electric vehicles and renewable energy technologies – which we wholeheartedly support – the world will use more oil each year through at least 2040. According to the International Energy Agency (IEA), if the world goes beyond the aggressive commitments made in Paris and achieves the 2C global goal, then oil demand would fall by 2040. Yet, oil demand will remain high for years after that.

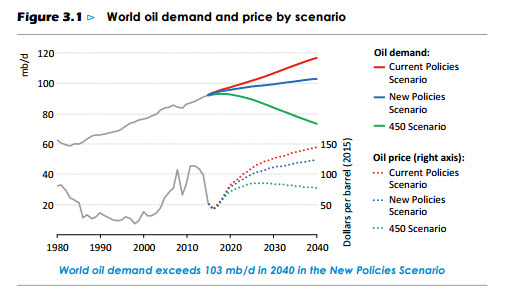

The IEA scenario that “achieves the 2C global goal”, the “450 Scenario” (green, what else, in the figure below), actually shows oil demand peaking in 2020 and declining fairly rapidly thereafter. By 2040, global demand decreases by about 20%.

IEA World Energy Outlook 2016

Hall Findlay and McLeod have confused the 450 Scenario with the IEA’s “New Policies” scenario (blue), which is approximately what will unfold if governments fulfil the pledges (INDCs, Intended Nationally Determined Contributions) made for the Paris COP meeting. If implemented, these policies would lead to a global temperature increase of 2.7 degrees or more, depending on what happens after 2040.

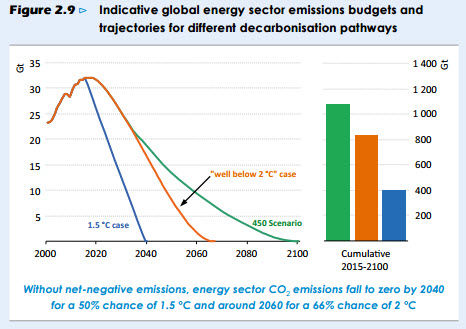

However, even the 450 scenario does not quite meet the unanimous international goal of the Paris Agreement:

The Paris Agreement’s central aim is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees Celsius.

Meeting the Paris targets will in reality require even more ambitious emissions reductions than the 450 scenario:

IEA World Energy Outlook 2016

Hall Findlay and McLeod write:

The world needs to take serious action to reduce global greenhouse-gas emissions and keep global temperature increases below 2C above pre-industrial levels. We agree on that.

They claim that this “serious action” is consistent with the “New Policies” IEA scenario in which oil demand peaks after 2040 and then remains high for years after that. They are mistaken.

But, isn’t there still room for the oil sands in a world of steadily shrinking demand that will keep us under 2 degrees? Volumetrically, there is, but economically, there probably is not.

Shrinking oil demand will lower prices and challenge the viability of the oil sands

The world has plenty of oil. The oil produced under the New Policies scenario up to the 2060s is equivalent (roughly) to the current proven reserves. Under the 450 scenario, it would take until the 2080s to use up this volume of oil.

Of course, the proven reserves will require development capital* and operational expenses to bring them to market. But under a falling demand scenario consistent with the Paris accord, where those dollars go will be very different than under the rising demand trend that oil companies have been accustomed to for a century or more.

According to the IEA, there exist technically recoverable resources of more than 6 trillion barrels, of which 2.2 trillion are conventional oil and 0.8 trillion are North American heavy oil and bitumen. There are plenty of non-bitumen resources that supply the world for many decades to come, even in a world in which emissions are not sufficiently constrained to avoid dangerous climate change.

Analysts who think that the Paris accords will mark a turning point in global efforts to reduce carbon-dioxide emissions say global oil consumption could start to wane as early as the 2020s. That would mean companies would have to focus exclusively on easy-to-access oil such as that in the Middle East and America’s shale-oil provinces, rather than expensive, complex projects with long payback periods, such as those in the Arctic, the Canadian oil sands or deep under the ocean.

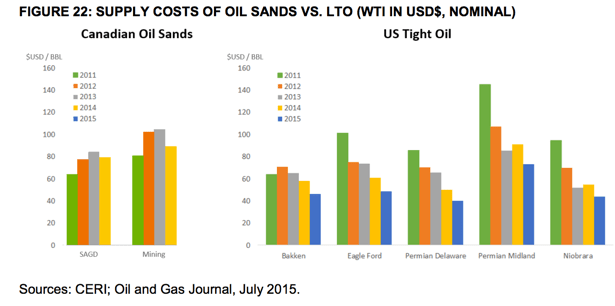

This figure from Rystad Energy via a report from the Oxford Institute for Energy Studies shows how the oil sands are the extreme marginal new resource in a world of abundant oil development opportunities:

See also this table from the Oxford Report that shows the 2015 WTI-equivalent breakeven costs for specific oil sands projects.

Furthermore, the trends in oil sands supply costs from 2011 to 2015 do not show consistent improvements, unlike those of the light, tight oil (fracked) oil in the US.

Nobody can predict oil prices with any precision. Future supply could, for example, be restricted by political instability or by deliberate production reductions by producer cartels. There is a chance that even in a world of falling demand, prices could stay high enough to justify new oil sands development. More likely, once a falling demand trend becomes established, holders of cheap-to-produce oil would move to seize their last chance to cash in by selling their products as if there were no tomorrow. This would depress prices to current levels (~$50) or lower, at which point new oil sands projects cannot be developed profitably.

Not only are the costs of producing bitumen high, but the low quality of the product commands a low market price, with a discount to high quality oil of about $20 per barrel. Recent agreements to reduce the sulphur content of oil used to power ships may result in a further discount to high-sulphur heavy crudes like bitumen.

What this amounts to is that if the world achieves the Paris Accord goal of reducing emissions enough to keep global warming “well below” 2°C, then there is likely little room for attracting the big capital needed for further production growth in the oil sands, at least beyond those projects that are currently under construction.

Hall Findlay and McLeod’s conclusion—that further expansion of the oil sands is compatible with the Paris Agreement—is flawed. It’s not environmentalists who should end the charade over the oil sands, it’s instead the “serious people” in Canada, including the Trudeau government and its apologists, who have fooled themselves into believing that long-term oil sands production growth is compatible with avoiding dangerous climate change. Canadian politicians from major parties are unable to state the obvious fact that the bulk of the oil sands resource will stay in the ground if emissions goals are to be met.

Betting on a long-term future for the oil sands is a cynical bet against effective implementation of global climate policies. If there are ever winners of such a bet, they will be few and their gains fleeting. The losers will be many, and their losses will be endured over centuries to come.

Update

*Andrew Leach on Twitter correctly reminds us that “proven reserves” include both developed and undeveloped reserves. Only the latter require development capital.

** Leach further remarks that oil sands supply costs are likely to have fallen in 2016. Apparently there is an updated Rystad report that estimates these new costs. I’ll update this post if I can track this information down.

Also, the Calgary Herald brings word of CERI report due soon, which looks at the potential for new technologies to greatly reduce upstream emissions and reduce production costs. I’ll report on it when it comes out.

Exxon has written down some 3.5 billion barrels of its proved reserves in its share of oil sands projects. This decision is based on strict SEC criteria for defining what resources may be booked as proven reserves. In this case, it would be based on end-2015 market prices, which have since risen. It’s quite possible that as prices rise and, if supply costs have fallen in 2016 and beyond, then these resources could again be restored as proven reserves in the future. This bookkeeping exercise may at least offer some insight as to where the value/cost boundaries lie in the oil sands.

Further update: the Globe and Mail have modified their piece, without giving any credit to my comment or apology for their errors.

Further, further update . CERI has a report out claiming that new technologies using siolvents will both lower costs and enpmisions. Markham Hislop has a news piece on it.

Are you sending in a response op ed to the Globe & Mail?

I might. I have just offered one to them.

I’d like to see your countering op-ed, Andy, although I expect the Globe and Mail wouldn’t consider that its idea of a ‘balanced’ debate, even if the paper is less overtly biased than the Wall Street Journal, the Washington Times, the National Post, the Mail, the Telegraph, or the Australian.

As for the ‘new pipelines and increased bitumen production are compatible with emissions reduction’ argument, it recalls a 20-year old Simpsons episode where Bart is placed in a remedial class. “Let me get this straight: we’re behind the rest of our class and we’re going to catch up to them by going slower than they are?”

Nice analogy from the Simpsons.

It’s true that the Globe and Mail is better on climate than many other papers. However, some of their columnists, especially Margaret Wente, are clueless on climate. But there is nobody there equivalent to the National Post’s denier chorus of Corcoran, Murphy, Solomon and so on. However, the Globe does have a very strong business and investing focus, which is inhently conservative. The very idea of the oil sands running down over coming decades rather than expanding giddily is as unimaginable to the business and investment writers apes would be seeing the Canadian banking sector dwindle.

Nevertheless, the paper does broadly support climate policy, even if if their editorial stance does not understand or accept what the broader implications are for the Canadian economy are over the next few decades.

Thought provoking. Thank you.

But why is there such a concern about CO2 emissions given that ice core analysis shows that CO2 follows temperature and lags temperature by hundreds of years?

Carbon dioxide acts both as a cause of global warming and as a feedback. A warming climate is expected to increase the release CO2 from oceans and the biosphere (at different speeds), driving warming ever higher. This is unlikely to be an out of control feedback loop, but it will make matters worse.

In the ice ages, orbital variations led to changes in solar warming in certain regions. This was enough to start to melt the vey large ice sheets and the loss of snow and ice cover allowed for less solar radion to be reflected out into space. As the world warmed, CO2 gradually came out of the warming oceans (over hundreds of years, since it takes that sort of time for them to overturn) and this increased concentrations in the atmosphere. All of this warmed the world a little more until the big ice sheets in N America and NW Eurasia disappeared and the process stabilized.

Now, we are adding a huge slug of CO2 on top of this through burning fossil fuels. It’s getting warmer, it will get warmer still and there are signs of feedbacks from the terrestrial carbon cycle.

You can read more about this here: https://skepticalscience.com/co2-lags-temperature.htm

Thank you for a comprehensive response. Much appreciated.